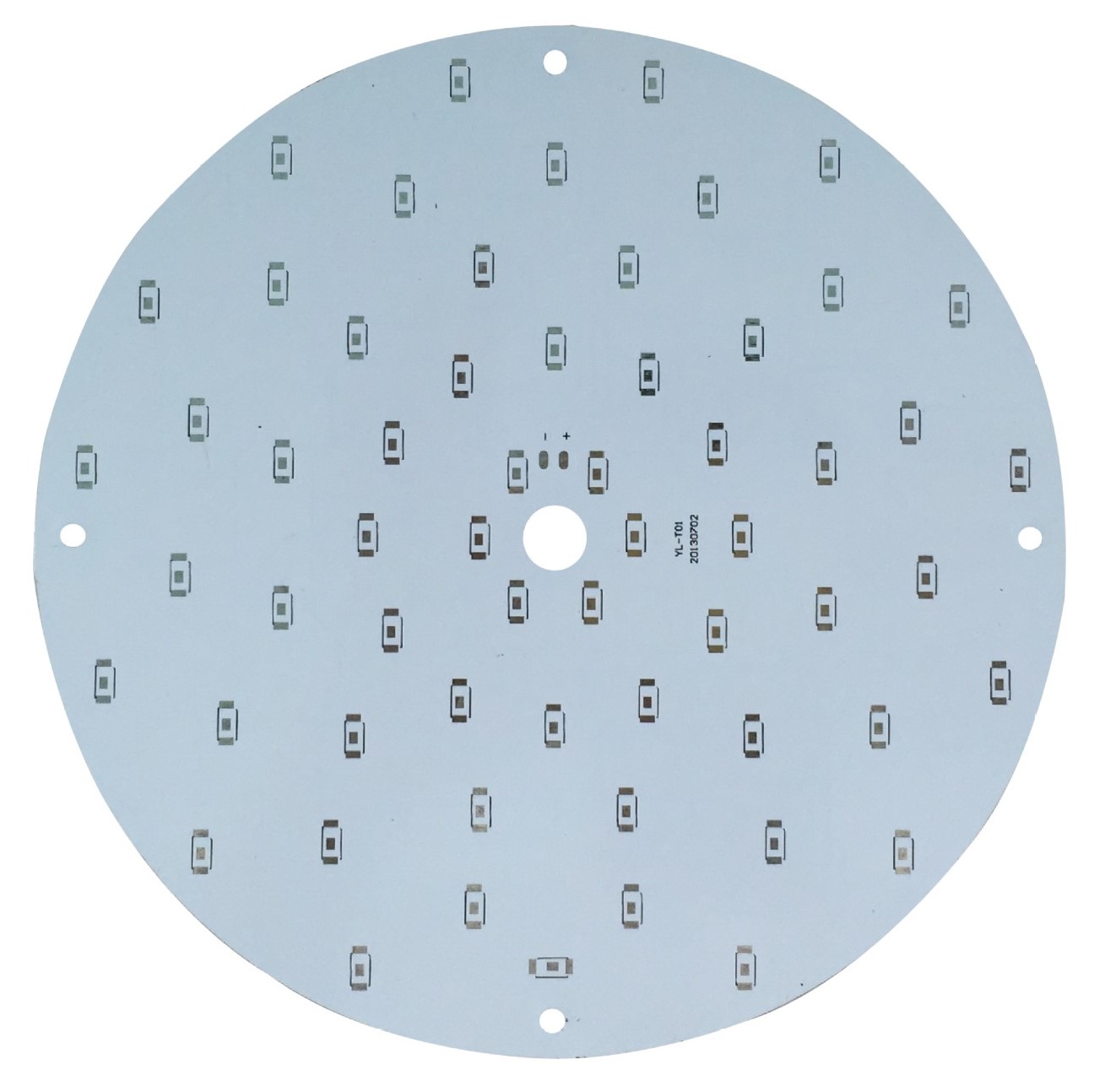

There is a factory cluster called "Silicon Valley Power" in Shenzhen, and the Baiwa Building has been closed. Last year, it was still a mobile phone assembly line. A security guard said: "It's closed, and the employees have gone back." Shenzhen is the epicenter of the global mobile phone industry, but today, it is very common to close factories. Chinese consumers prefer smartphones, which can access the Internet and have powerful functions. This has caused disasters to OEMs. In the past, thousands of small companies provided low-end mobile phones to Chinese domestic consumers. In general, low-end mobile phones only need ordinary phones. Double-sided circuit board accessories.

Some companies have started copying the latest brand of mobile phones, and some companies are producing new products for Chinese non-fixed workers, small-town businessmen, and farmers. These products do not have a brand, or the brand is unknown, and the price is much lower than that of Nokia phones.

About half of the mobile phones produced in the Chinese mobile phone market in 2010 came from these companies, but they are now in a difficult situation. Gartner estimates that OEM mobile phones fell by 7% in 2011 to 186 million units, accounting for 42% of China's mobile phone sales last year, and sales this year will fall by 30%. One reason for the decline is the launch of 3G services. Consumers want to use their mobile phones to access the Internet, while the smart phone circuit boards are HDI motherboards or multi-layer circuit boards. Operators also provide subsidies for smart phones and market them in small cities, where OEM phones dominate.

Gartner analyst Sandy Shen said: "Consumers are becoming more and more mature, they have higher quality requirements, and they start to like branded products. Copycats have fallen behind, especially common motherboard copy phones."

Hundreds of mobile phone manufacturers closed their doors due to market changes. For others, change also represents opportunity. Just beside the closed factory "Silicon Valley Power", Mei Saichun, manager of the company's SOP Group, a medium-sized mobile phone manufacturer, explained: "We have made a big investment in quality control." He said, pointing to the new equipment purchased. Every month, SOP produces 300,000 mobile phones, of which about half are smart phones that use high-end circuit board accessories, such as HDI and multilayer circuit boards.

Some companies are actively establishing their own brands, such as Tianyu, Gionee, Coolpad, Meizu, Oppo, and Backgammon. In developed countries, Huawei is also advancing into the consumer market. They also use HDI, multi-layer circuit boards, High-precision circuit board.

Second-tier mobile phone vendors are not easy. In the past, there was a big price difference between feature phones and low-end mobile phones of global mobile phone brands. Now, due to operator subsidies, the price difference between global brands and phones and smartphones from cottage factories has become smaller. In addition, it is more difficult for mobile phone vendors to achieve differentiation. Coolpad vice president Su Feng (transliterated from Su Feng) said: "Smartphones are too similar to each other, with large screens, small size ranges, fewer buttons, and fewer colors."

Some companies adopt different strategies to target niche markets. For example, Oppo and Backgammon target women. Coolpad also cooperates with operators.

Meizu runs its own app store, and Meizu sales director Hua Hailiang said: “In order to achieve differentiation, we focus on the program, not the hardware function.” Last week, the Meizu App Store was downloaded 100 million times, while Apple’s global program downloads reached 25 billion times. There is another opportunity, that is, underdeveloped areas outside of China. About one-third of SOP's mobile phones are sold in Indonesia, India and Ghana. Adam Chen, head of the SOP export department, said: "In fact, there is still a lack of 3G in South Asia and Africa. Many consumers are illiterate and can't afford smartphones. In the next 2-3 years, feature phones will still be the mainstay."

Despite the challenges, the growing smartphone market will still bring opportunities for Chinese second-tier brands. IDC predicted last week that China will surpass the United States as the largest smartphone market this year, and India and Brazil will also enter the top 5 in 2016. In order to seize opportunities in emerging markets, smart phone vendors need to develop low-end smart phones, which have a complete and powerful experience. And ordinary circuit board factories must keep up with the trend and transform to produce HDI and multi-layer circuit boards, otherwise they can only be closed with the popularity of smart phones.